Because, after all, corporations have a duty to be “economically patriotic.”

Because, after all, corporations have a duty to be “economically patriotic.”

What??

From Reuters.com:

U.S. Treasury urges Congress to act on corporate tax dodge deals

by Jason Lange and Kevin Drawbaugh

(Reuters) – Calling for a new sense of “economic patriotism,” U.S. Treasury Secretary Jacob Lew urged Congress on Wednesday to take steps quickly to discourage U.S. companies from moving their tax domiciles abroad to avoid federal taxes.

Please allow me to translate “Leftist-Speak.” The word “discourage” means to outlaw it in an act from DC. As in: make it illegal.

“Congress should enact legislation immediately,” Lew told a business conference in New York hosted by cable television channel CNBC. “We should have some economic patriotism here.”

Lew’s remarks came amid a wave of corporate deals known as inversions, in which a U.S. company shifts its tax home base to a lower-tax country by combining with a company based in that country. Popular destinations are Ireland and the Netherlands.

“Economic patriotism.” Hmm. Let me get back to that in a moment.

Senate Majority Leader Harry Reid told reporters on Wednesday that inversion legislation was needed before lawmakers try to revamp the U.S. tax system. “It’s taken far too much time,” Reid said. “If we don’t do something about inversion, there will be nothing to do tax reform on.”

Excuse me? Was that Harry Reid making noise like he is interested in some kind of tax reform? I’ll believe Harry Reid is truly interested in tax reform when I win the lottery and I learn to fly a Boeing 787.

But here is the true crux of the biscuit:

“We have a corporate tax policy which is driving capital and companies overseas,” JPMorgan Chase & Co Chief Executive Jamie Dimon, one of the nation’s most influential bankers, said on a conference call with reporters on Tuesday.

Stan Druckenmiller, a hedge fund manager and investing legend who created Duquesne Capital Management and knows the economy inside and out, weighed in on Jack Lew’s statement about “economic patriotism” and tax inversion.

From WSJ.com’s Money Beat:

Druckenmiller: Washington Needs to Fix Taxes, Not Blame CEOs

by Maureen Farrell and Rob Copeland

Legendary money-manager Stanley Druckenmiller says CEOs shouldn’t be criticized for inking deals to cut their own taxes. They’re simply following U.S. law.

Speaking at CNBC’s Delivering Alpha conference, Mr. Druckenmiller said criticism instead should directed toward Congress, which should be held accountable for creating the right tax policy.

“We’re being unpatriotic, we being the corporate community, because we’re obeying the laws on their books? That’s a little weird to me,” Druckenmiller says. “These guys they are obeying the law. If you don’t like it, change the law.”

Mr. Druckenmiller was responding to a rising tide of complaints coming from Washington over the spate of so-called tax inversion deals, in which U.S. companies buy firms headquartered in a lower-tax-rate country and redomicile there.

This morning at the CNBC conference, U.S. Treasury Secretary Jack Lew called for a crackdown on tax inversions, citing the need for “economic patriotism.”

There you have it. “Economic patriotism” is, to a Leftist, the duty to lose money if you’re a corporation, and the duty to endure every hardship and regulation placed upon it by DC and state and local politicians.

Just shut up and take your lumps, Evil Corporatists. You deserve that and more.

Finally, Druckenmiller makes an understated comment regarding an economic collapse:

“The current policy makes no sense from a risk-reward basis…extraordinary money measures are likely running into sharply diminishing rewards,” he says. “On the other hand, history shows potential long term costs could be quite severe.”

“I don’t know if the outcome will be benign. I really don’t. But neither does the Fed.”

Another article about Druckenmiller’s economic thoughts here. He also speaks about government spending:

That said, how about some actual corporate tax facts?

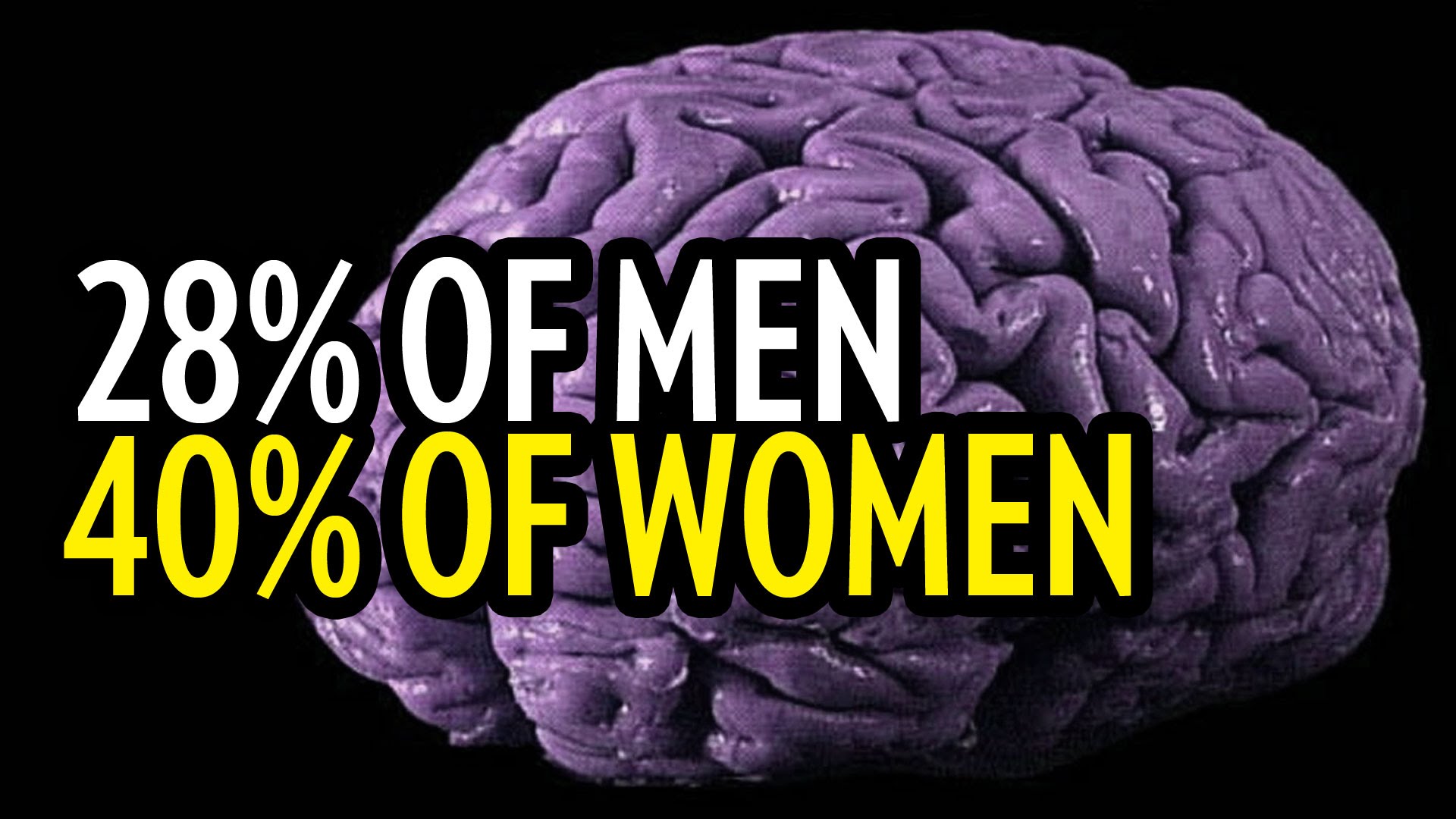

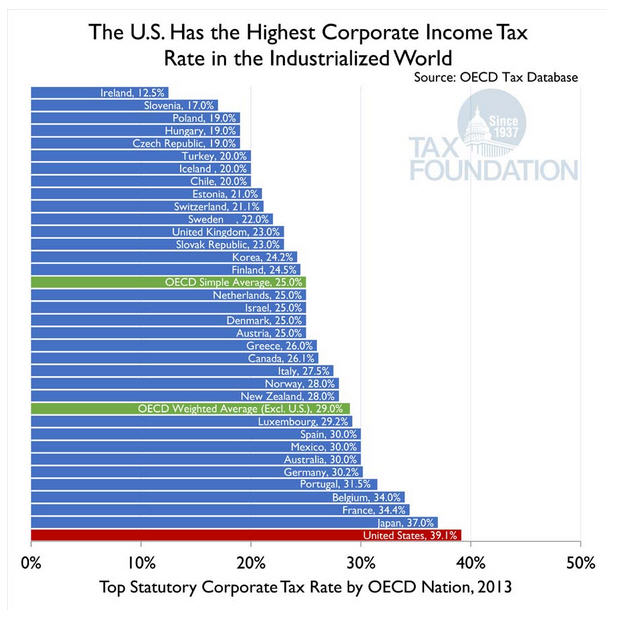

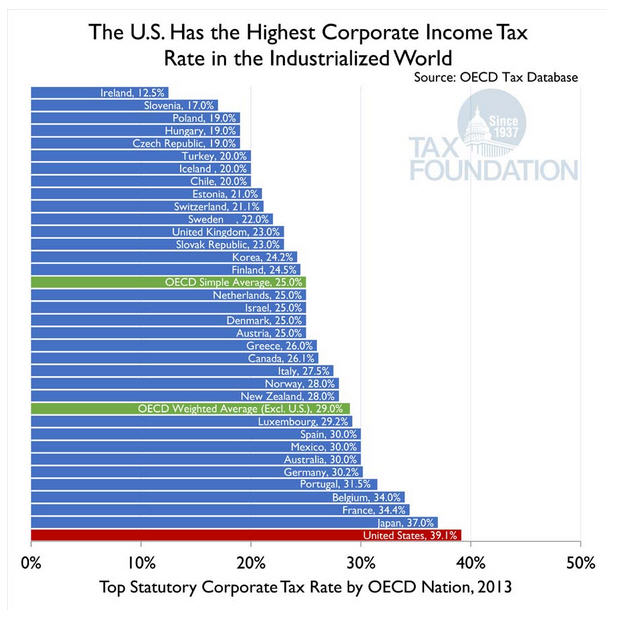

The United States has the highest corporate tax rate on the planet at roughly 40%. Check the graphic.

So: a shock that US corporations are seeking to minimize their tax exposure?

So: a shock that US corporations are seeking to minimize their tax exposure?

The WSJ theorizes:

How much revenue does the U.S. Treasury stand to lose from corporate tax inversions? It is difficult to say precisely, but one estimate puts the figure at close to $20 billion.

A nonpartisan congressional research panel said the U.S. would receive an additional $19.46 billion over a decade if most new tax inversions were essentially halted with proposed changes to the tax code. The estimate, by researchers at the Joint Commission on Taxation, is based on estimates from previous inversions.

So let’s revisit my thought above, regarding “economic patriotism.” As in, it’s “economically patriotic” for corporations to remain in the United States no matter the onerous rules and regulations and tax structures levied against them.

I say, frankly: bullshit.

First and foremost, it is not the job of any corporation to lose money because DC levies layer after layer of regulatory strictures and fees and taxes. Let’s be frank: a corporation exists to make an actual profit. An Evil Profit. And if it does not make a profit it can no longer be a viable corporation. It will fail.

If DC were to create a law disallowing corporations to seek so-called “tax inversions,” then you would conclusively see a limitation on the number of new companies created. Because: what would be the point? If you cannot expand, if you cannot do what you need to do when you need to do it in a volatile economic environment, why would you create a new company in the United States?

This wouldn’t much affect smaller businesses. But it would affect larger businesses and smaller businesses whose ideas and products and services have the potential to greatly expand in a short amount of time because of demand and viability.

Do this, DC, and every other nation would cheer because US businesses would thusly be so incredibly hamstrung. China and Russia and India and Brazil would applaud with great fervor.

It would be akin to this: you have worked in Fornicalia. Upon retirement, because of tax preferences, you wish to relocate to Nevada. But Fornicalia says you can’t. You still have to pay Fornicalia taxes AND pay taxes to the state into which you relocate. This isn’t fair and it isn’t in keeping with freedom. Shock. Fornicalia once demanded this. And its stance was shot down.

Because Fornicalia believed it was my duty to support its imperial economic policies in my dotage.

DC wants to demand this now. Because businesses have a duty to lose money when DC says so.

“Economic patriotism” or not? Please weigh in.

BZ

Above, Mysterians step in and kick the slats out of the stock market.

Above, Mysterians step in and kick the slats out of the stock market.