From Australia’s TheAge.com:

From Australia’s TheAge.com:

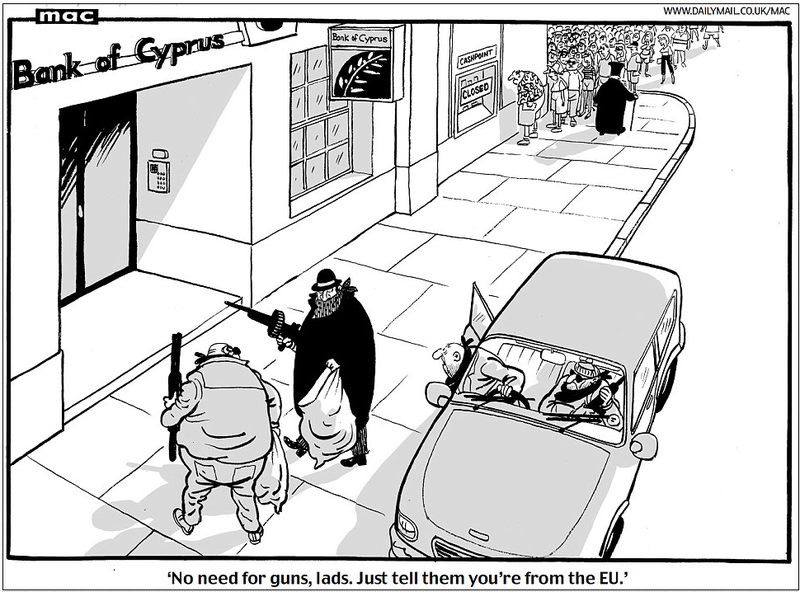

In a move that could set off new fears of contagion across the eurozone, anxious depositors drained cash from ATMs in Cyprus on Saturday, hours after European officials in Brussels required that part of a new €10 billion ($12.6 billion) bailout must be paid for directly from the bank accounts of savers.

The move – a first in the three-year-old European financial crisis – raised questions over whether bank runs could be set off elsewhere.

Read that paragraph again, carefully.

A bank in Belgium, a country far away from yours, has declared that it gives itself the authority to wade into your personal savings account in order to pay back a loan your country acquired from the “higher banking authority.”

And anyone wonders why people are raiding their own savings accounts via ATM?

Reuters has more:

(Reuters) – Cyprus’s parliament has postponed until Monday an emergency session to vote on a levy on bank deposits after signs that lawmakers might block the surprise move agreed in Brussels to help fund a bailout and avert national bankruptcy.

In a radical departure from previous aid packages, euro zone finance ministers want Cyprus savers to forfeit up to 9.9 percent of their deposits in return for a 10 billion euro ($13 billion) bailout to the island, which has been financially crippled by its exposure to neighboring Greece.

So let me understand: taxpayers in Cyprus are, following a vote on Monday, potentially to lose 10% of their savings in order to stave off a fiscal problem due to an issue of proximity to a larger debtor nation?

Ladies, this is what you get when you turn your sovereignty over to a larger enterprise.

So let’s just see how this plays out, and how it affects the minds of taxpayers in neighboring countries.

Bank run, anyone?

Bueller?

BZ

A policeman stands guard in front of trucks carrying containers at the Central Bank in Nicosia March 27, 2013. The contents of the containers could not be verified by Reuters but local media reported they contained cash for the banks’ reopening on Thursday. Cyprus is set to restrict the flow of cash from the island and may curb the use of Cypriot credit cards abroad as it tries to avert a run on its banks after agreeing a tough rescue package with international lenders.

A policeman stands guard in front of trucks carrying containers at the Central Bank in Nicosia March 27, 2013. The contents of the containers could not be verified by Reuters but local media reported they contained cash for the banks’ reopening on Thursday. Cyprus is set to restrict the flow of cash from the island and may curb the use of Cypriot credit cards abroad as it tries to avert a run on its banks after agreeing a tough rescue package with international lenders.

By Wolfgang Münchau

By Wolfgang Münchau