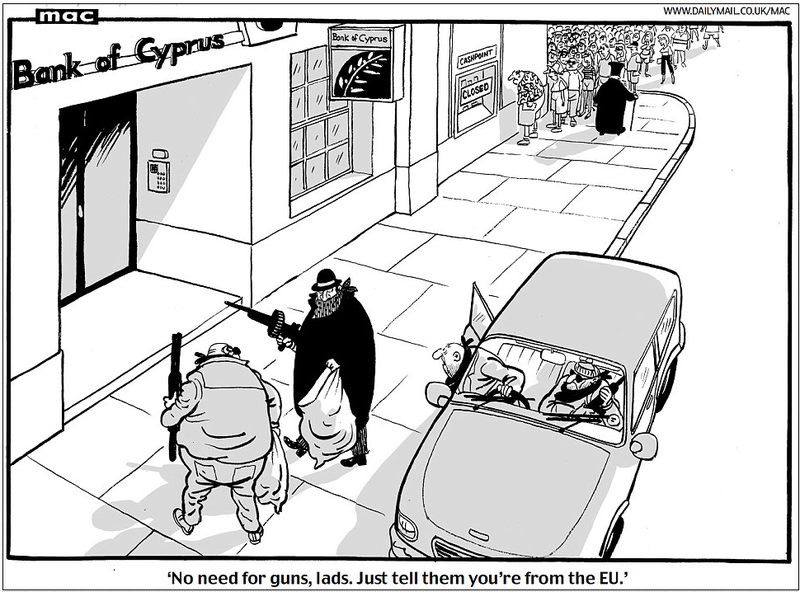

But: will Greece stick to the Euro and, conversely, will the Eurozone stick to Greece?

From FoxNews.com:

Greece, Eurozone leaders agree to new bailout deal

Marathon talks between Greece and its European creditors ended with a new bailout agreement early Monday, at least temporarily averting the prospect of Athens exiting the single currency and subsequent global financial chaos.

Please note the key word in that paragraph.

The deal calls for Greece, already reeling from harsh austerity measures, to cut back even further in exchange for more loans without which its financial system would surely collapse. It still requires approval from Greece’s parliament by the end of Wednesday.

What do those measures of further “austerity” constitute? Keep reading.

A breakthrough came in a meeting between Tsipras, Hollande, German Chancellor Angela Merkel and (Eurozone Council President Donald) Tusk, after the threat of expulsion from the euro put intense pressure on Tsipras to swallow politically unpalatable austerity measures in exchange for the country’s third bailout in five years.

Oh no, Greece forced to swallow its pride for being a drunken cash whore binging on the money of other states? Say not so!

The deal includes commitments from Tsipras to push a drastic austerity program including pension, market and privatization reforms through parliament by Wednesday. In return, the other eurozone leaders committed to start talks on a new bailout program that should stave off the imminent collapse of the Greek financial system.

But wait. What if Tsipras doesn’t manage to push through those “drastic” reforms? What then? Start all over?

Anglea Merkel will tire entirely of Greece should that occur.

Has Greece truly staved off doom? Or will it go back to doing what it does best?

Oh yes, time will tell.

BZ

By Wolfgang Münchau

By Wolfgang Münchau